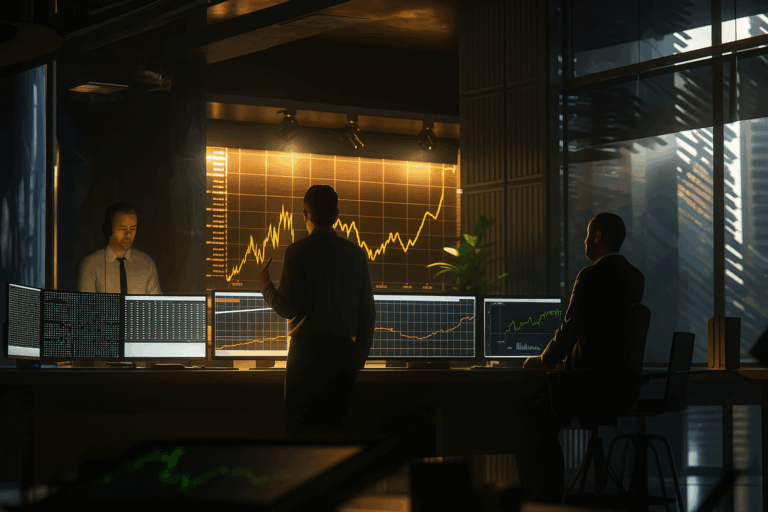

Investing in real estate property is a proven strategy for building wealth and achieving financial security, offering both passive income opportunities and long-term asset appreciation. Whether you are a beginner or an experienced investor, understanding the fundamentals of real estate investment—along with essential steps like company registration for managing properties professionally—is crucial for making informed decisions.

In this guide, we will explore various aspects of investing in real estate property, including strategies, benefits, risks, and step-by-step instructions to get started.

Why Invest in Real Estate Property?

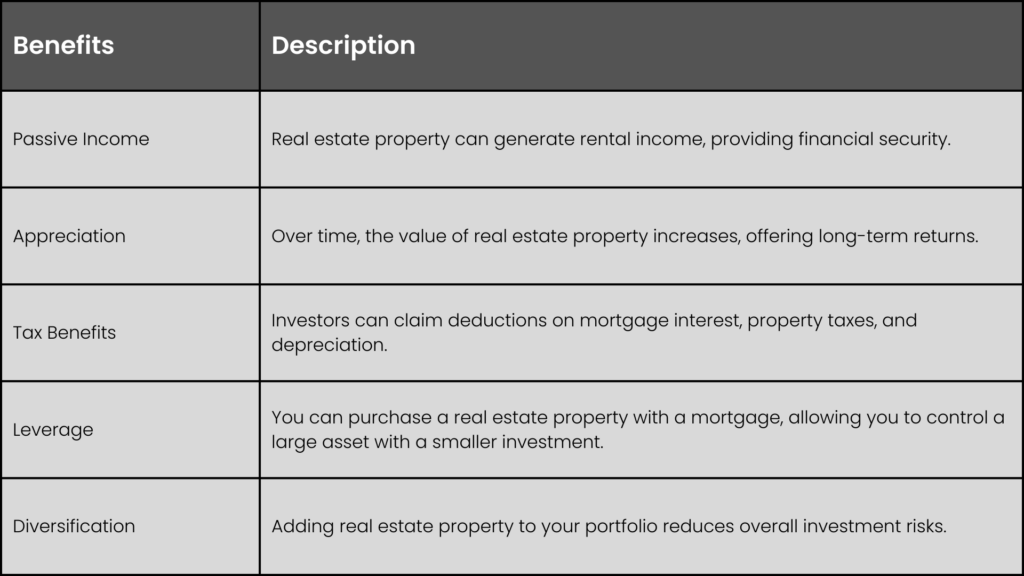

Investing in real estate properties offers multiple benefits, making it a preferred choice for many investors. Here are some key advantages:

Types of Real Estate Property Investments

There are various ways to invest in real estate properties. Each type has its unique benefits and risks, such as market fluctuations for residential properties, higher maintenance costs for commercial real estate, and liquidity concerns for REITs and crowdfunding investments. Below are some common investment options:

1. Residential Real Estate

- Single-family homes

- Multi-family homes (duplexes, triplexes, apartments)

- Condominiums and townhouses

- Vacation rental properties

2. Commercial Real Estate

- Office buildings

- Retail spaces

- Warehouses

- Industrial properties

3. Real Estate Investment Trusts (REITs)

- Publicly traded companies that own income-generating real estate

- Allows investors to invest without directly owning a real estate property

4. Fix-and-Flip Properties

- Buying distressed properties, renovating them, and selling for profit

5. Real Estate Crowdfunding

- Investing in properties through online platforms

- Requires a lower initial investment compared to direct ownership

Steps to Invest in Real Estate Property

Investing in real estate property requires careful planning and strategic decision-making. By following a step-by-step approach, you can minimize risks and maximize returns on your investment.

1. Define Your Investment Goals

Before investing in real estate property, determine your financial objectives:

- Are you looking for long-term appreciation or short-term profits?

- Do you want a passive income stream through rentals?

- What is your risk tolerance?

2. Research the Market

Understanding the real estate market is crucial. Consider:

- Property prices in different locations

- Rental yield and demand

- Economic growth and infrastructure development

- Market trends and property appreciation rates

3. Arrange Financing

Investing in real estate property requires capital. Here are some financing options:

- Mortgage Loan: Banks and financial institutions offer home loans.

- Hard Money Loans: Short-term, high-interest loans for property investors.

- Private Investors: Partnering with individuals who provide capital.

- Savings and Self-Funding: Using personal savings for investment.

4. Choose the Right Property

When selecting a real estate property, consider:

- Location (proximity to amenities, schools, and business centers)

- Property condition and renovation requirements

- Rental demand in the area

- Future resale potential

5. Conduct Due Diligence

Before purchasing, conduct thorough research:

- Verify property documents and legal status

- Assess the property’s structural integrity

- Check for any pending dues or disputes

6. Purchase and Manage the Property

Once you finalize a real estate property, follow these steps to complete the transaction legally and efficiently:

- Hire a real estate agent for negotiations.

- Consult a lawyer for legal documentation and contracts.

- Secure financing and finalize the mortgage paperwork.

- Conduct a final inspection to ensure the property meets expectations.

- Sign the necessary documents and close the deal.

- If it’s a rental property, establish a management plan for tenants.

- Hire a real estate agent for negotiations

- Consult a lawyer for legal documentation

- Manage tenants effectively if it’s a rental property

7. Monitor and Scale Your Investments

- Keep track of rental income and expenses

- Regularly maintain the property to preserve its value

- Consider reinvesting profits into additional real estate property

Risks Involved in Real Estate Property Investment

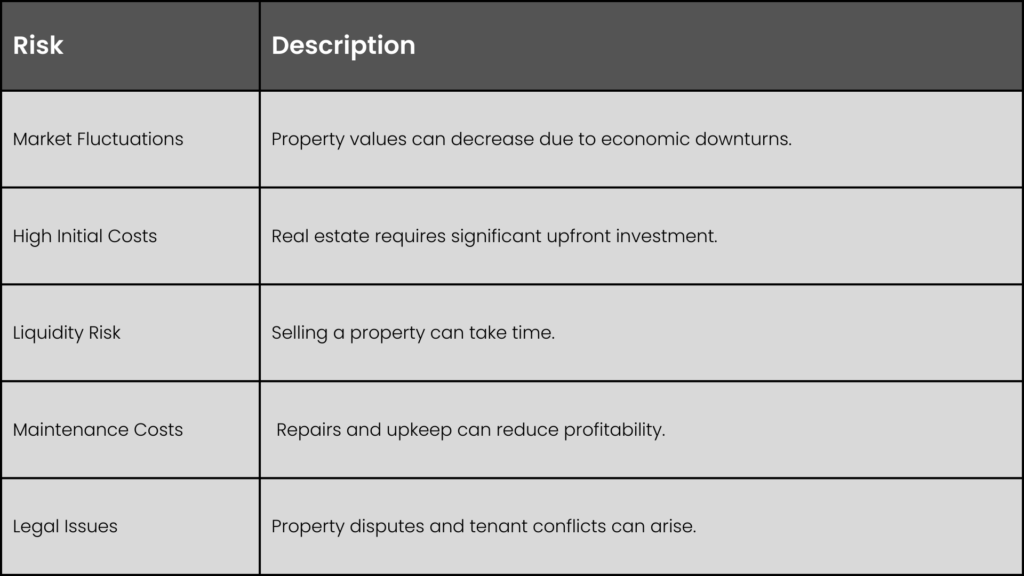

Although investing in real estate properties is profitable, it comes with potential risks. However, investors can mitigate these risks by conducting thorough market research, diversifying their portfolio, maintaining an emergency fund, and seeking professional advice when necessary.

Tips for Successful Real Estate Property Investment

- Start Small: If you are a beginner, begin with a small property before investing in larger projects.

- Build a Network: Connect with real estate agents, brokers, and property managers.

- Stay Updated: Keep an eye on market trends and government policies.

- Diversify Investments: Invest in different types of real estate property to minimize risks.

- Use Technology: Utilize online platforms for property research and management.

Conclusion

Investing in real estate properties is a smart way to generate wealth and achieve financial independence. However, it requires careful planning, market research, and risk management. By following the right strategies and staying informed, you can build a successful real estate portfolio. Whether you aim for passive rental income, long-term appreciation, or fix-and-flip profits, real estate property remains a lucrative investment opportunity.

Frequently Asked Questions (FAQs)

1. How much money do I need to start investing in real estate property?

The required investment depends on the properties type and location. Some options, like REITs or crowdfunding, allow investments with a few hundred dollars, while direct property purchases require substantial capital.

2. Is real estate property a good investment for beginners?

Yes, real estate property is an excellent investment for beginners, provided they conduct thorough research, seek expert advice, and start with manageable properties.

3. How can I finance my first real estate property?

You can finance your first property through mortgages, hard money loans, private investors, or personal savings.

4. What is the best location to invest in real estate property?

The best location depends on factors like job opportunities, infrastructure development, rental demand, and future appreciation potential.

5. How can I minimize risks in real estate property investment?

To minimize risks, diversify your portfolio, conduct proper due diligence, invest in high-demand areas, and maintain an emergency fund for unforeseen expenses.

Get Expert Guidance for Real Estate Investment Success

Investing in real estate can be highly rewarding, but the right strategy is key to maximizing returns. Whether you’re a beginner or an experienced investor, professional advice can help you make informed decisions.

Contact us today to get expert support on market analysis, property selection, and investment planning — and take the first step toward building your wealth through real estate.

Stay Updated with Real Estate Insights

Want to stay ahead in the property market? Follow our expert tips and strategies to unlock new opportunities and make smarter investment decisions.